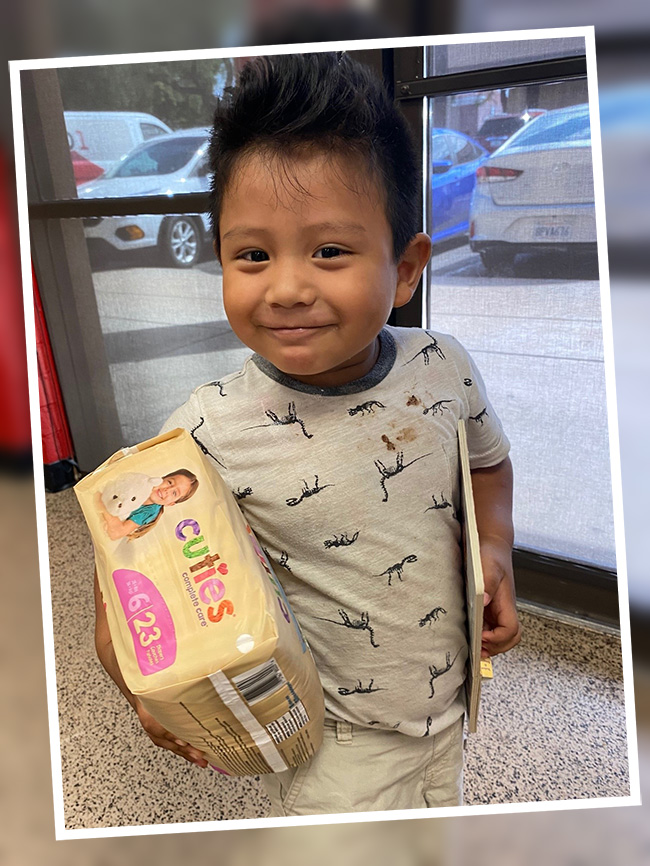

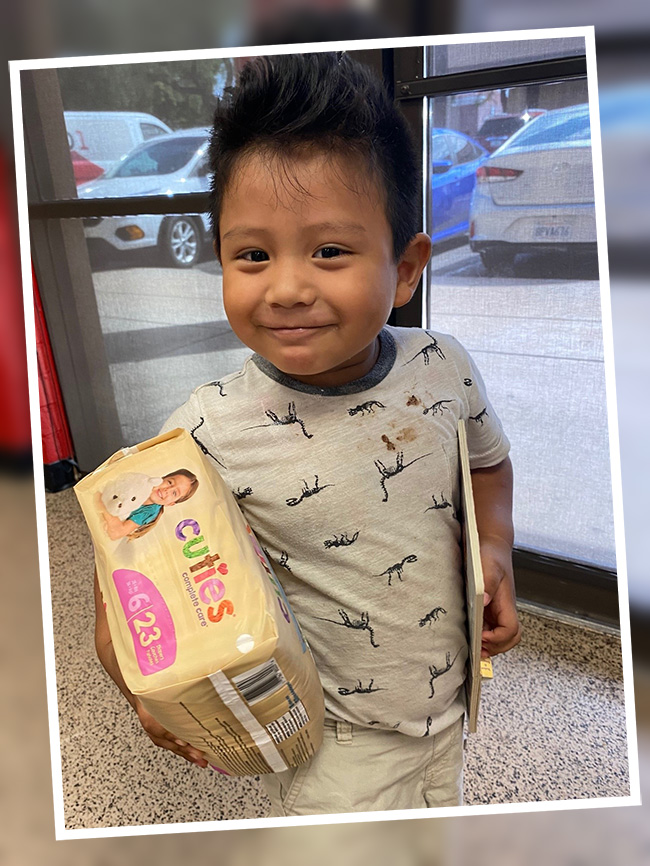

The UP-SIDE to your Arizona State Taxes!

Until April 15, you can still TAKE THE CREDIT for feeding families by utilizing the Arizona Charitable Tax Credit program. How does it work? You figure your state tax liability for 2021 and donate what you owe to the state to HCC instead. Arizona law allows you to donate a maximum of $400 if you file as a single and $800 if you file as a married couple. After you make your online tax credit gift, simply submit your receipt, and ask for your dollar-for-follar credit.

Be sure to include HCC’s state code: 20157.

This is truly a win-win for Arizona families who are in need! Click here to donate your Arizona Charitable Tax Credit and watch our 1- minute video explaining the program.